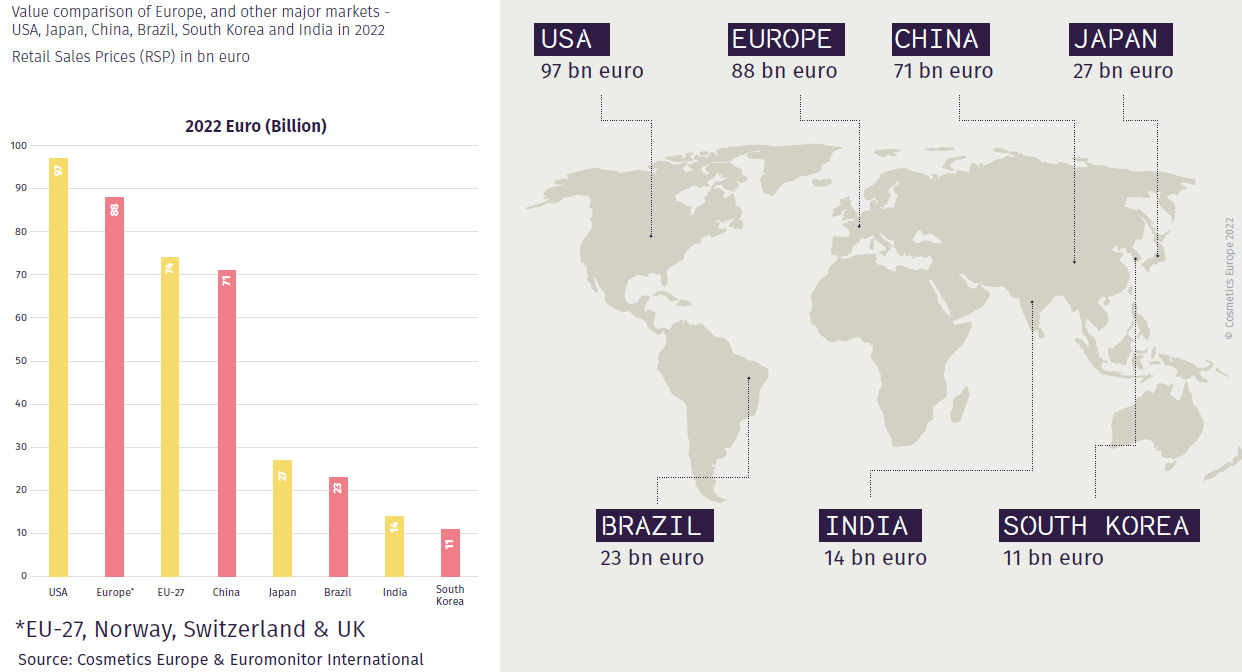

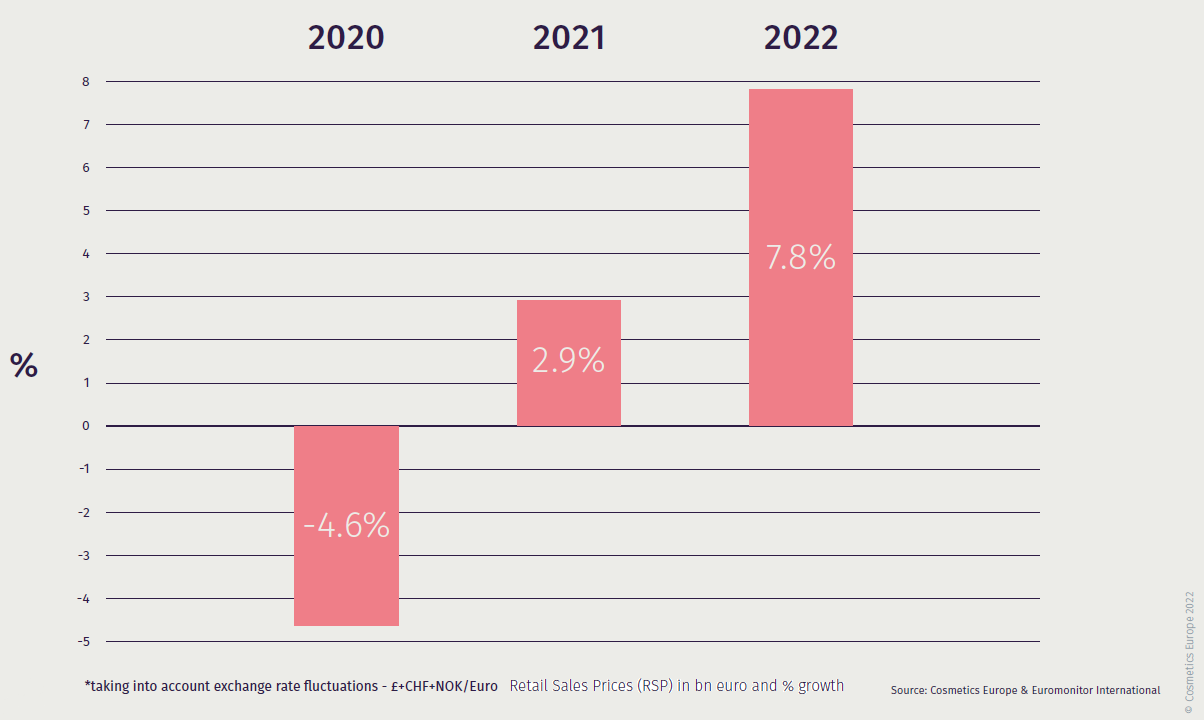

Cosmetics Europe - the personal care association, has issued its latest Market Performance Report noting that the European* cosmetics market was worth EUR €88 billion at Retail Sales Price (RSP) in 2022, making Europe and the USA the largest cosmetics markets in the world (Europe 2021- EUR €80 billion RSP).

European Cosmetics Market Annual Growth 2020-2022

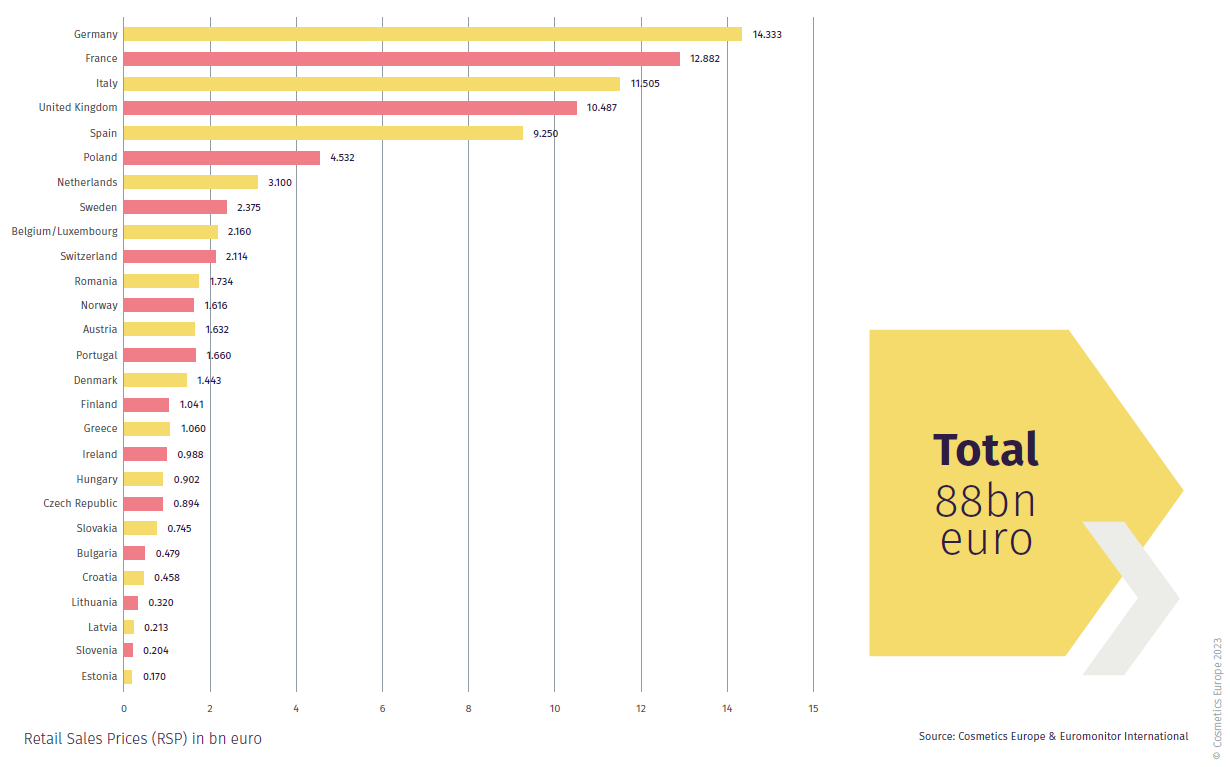

Market Volume by Country in 2022

The largest national markets for cosmetics and personal care products within Europe are: Germany maintaining its position as the largest market for cosmetics (EUR €14.333 billion), France (EUR €12.882 billion), Italy (EUR €11.505 billion), the UK (EUR €10.487 billion), Spain (EUR €9.250 billion) and Poland (EUR €4.532 billion).

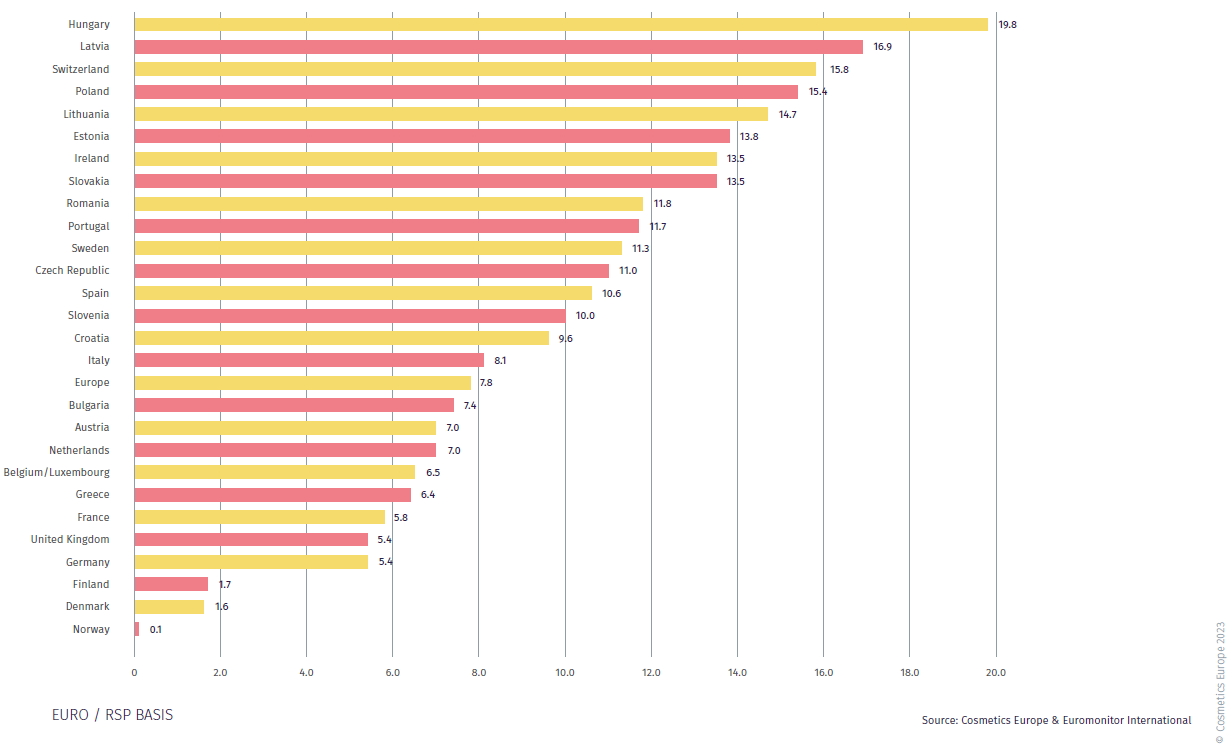

Market Growth over 2021 (%)

The top five best performing countries were Hungary (+19.8%), Latvia (+16.9%), Switzerland (+15.8%), Poland (+15.4%) and Lithuania (+14.7%).

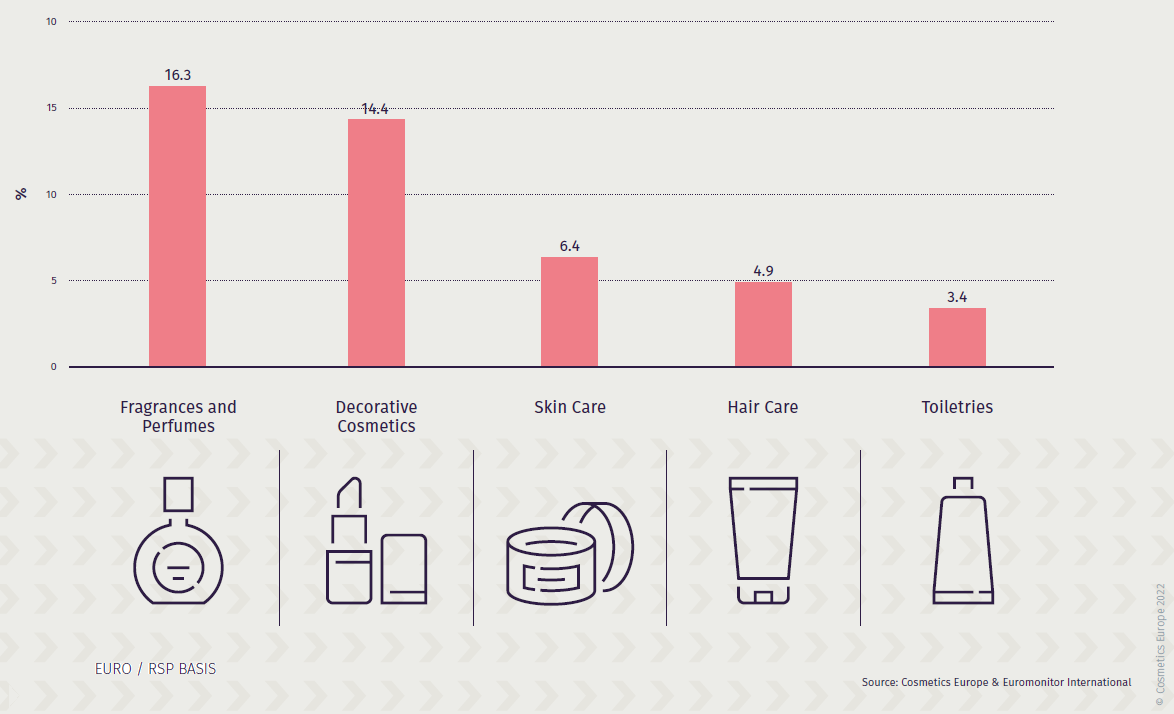

Market Changes by Product Category 2021-2022 (%)

All categories showed positive growth over 2021 with fragrances and perfumes and decorative cosmetics performing most strongly.

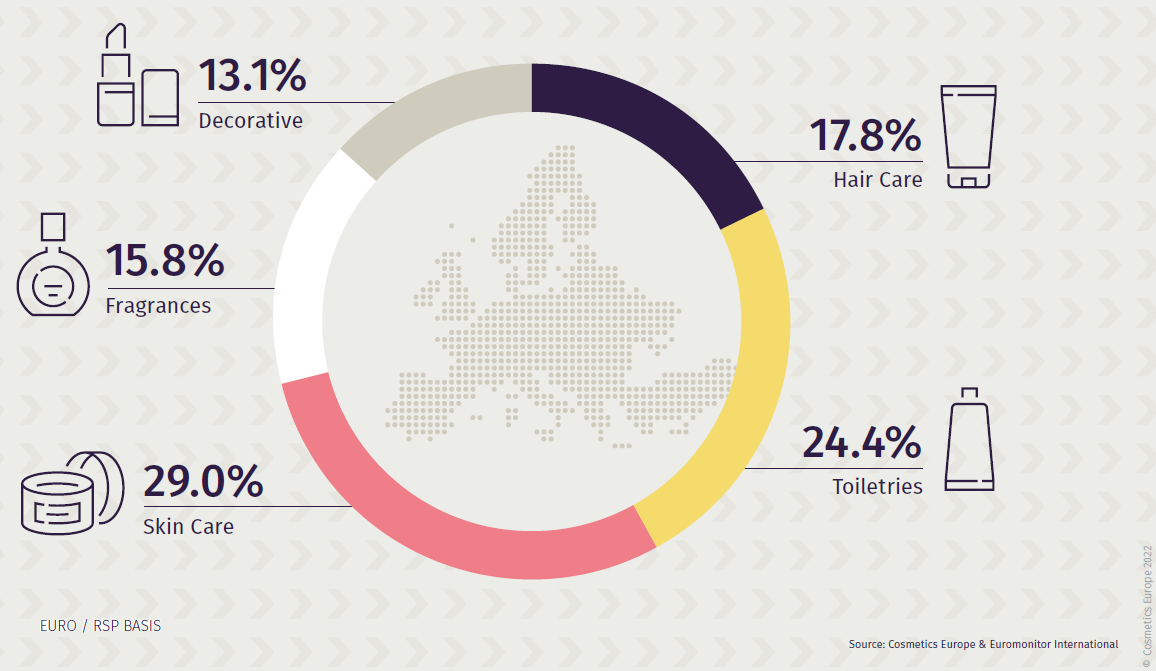

Market Share by Product Category 2022 (%)

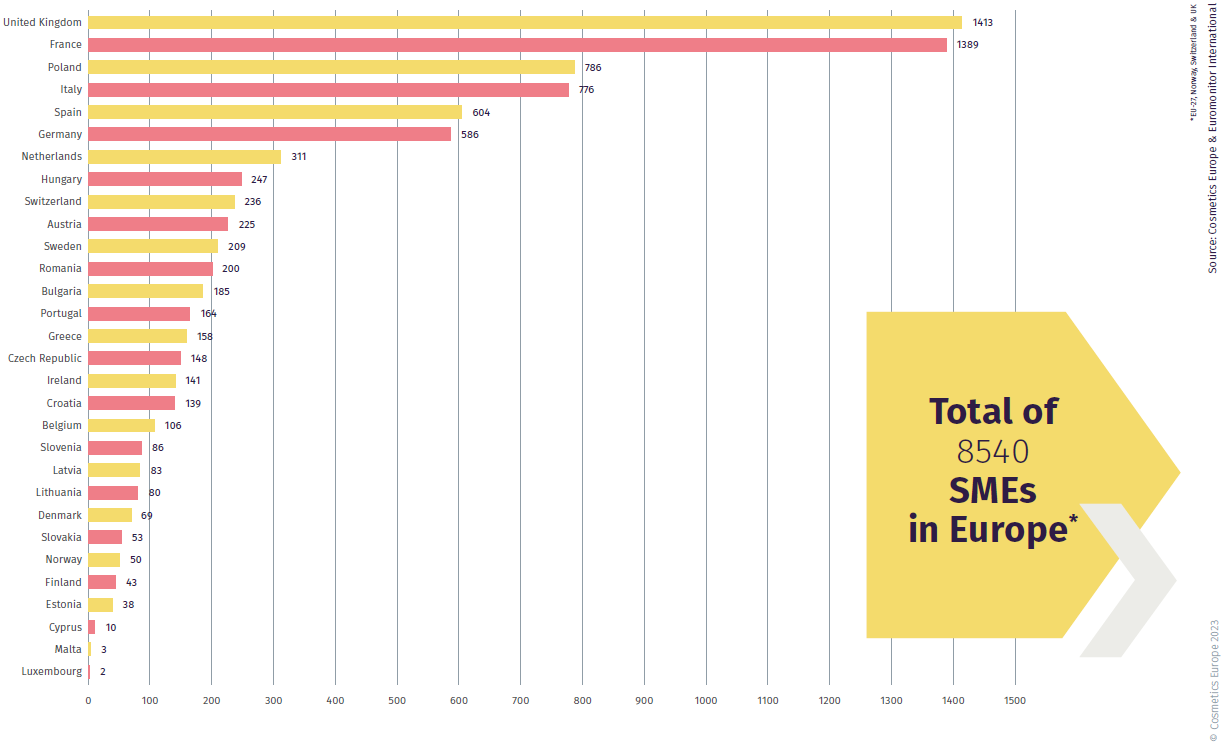

SMEs Across Europe

The strength of the entrepreneurial cosmetics industry lies in the mix of both large and small companies. SMEs are key drivers of innovation and economic growth being agile in bringing new ideas to market. Indeed, following the global pandemic there has been a rapid rise in new small companies emerging. From 6916 SMEs in 2021, there are now 8540 SMEs in Europe (EU27, Norway, Switzerland and UK).

The UK had a rapid rise in SMEs from 628 in 2021 to leading the table at 1413 SMEs in 2022, with France in second place at 1389 (from 1173 in 2021). Poland stabilised at 786 (733 in 2021). Italy grew back to 776 close to its 2020 level from 667 in 2021).

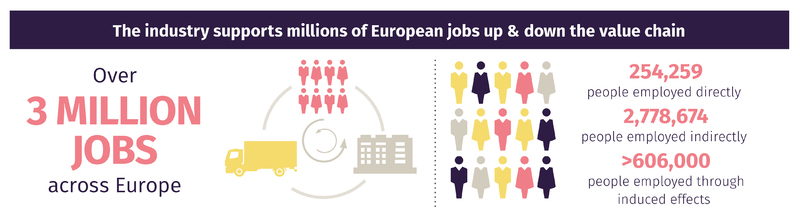

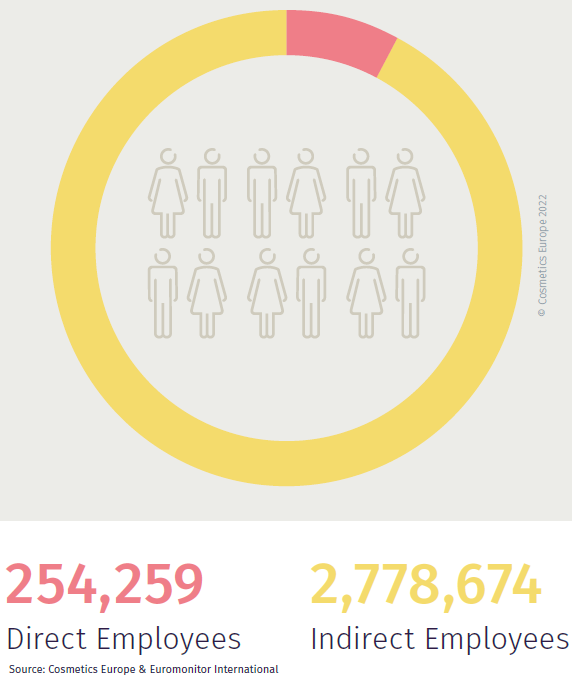

Employment Overview

Employment Breakdown 2022

For the full report and further information on the European industry see the Cosmetics Europe website.